Donations

Flow for a cause: Supporting communities through yoga charity

Why donate us?

Donating to charity is a way of expressing kindness, compassion, and generosity to others who may be less fortunate or in need of help. Donating to charity can have many benefits, not only for the recipients, but also for the donors. Here are some of the reasons why donating to charity is important:

-Donating to charity can make you feel good. Research has shown that giving to charity activates the reward center of the brain, which releases chemicals such as dopamine and oxytocin that make you happy and satisfied. Giving to charity can also boost your self-esteem, as you feel proud of your contribution and aligned with your values.

-Donating to charity can support important causes. There are many issues and problems in the world that need attention and action, such as poverty, hunger, disease, education, environment, animal welfare, human rights, and more. By donating to charity, you can help fund the work of organizations that are dedicated to addressing these issues and making a positive difference in the world.

-Donating to charity can provide tax benefits. Depending on the country and the type of charity, you may be able to claim a tax deduction for your donation, which can reduce your taxable income and save you money.

-Donating to charity can encourage giving. When you donate to charity, you can inspire others to do the same, either by sharing your story, inviting them to join you, or matching their donations. Giving can create a ripple effect of generosity and kindness, which can spread throughout your community and beyond.

-Donating to charity can create a lasting legacy. When you donate to charity, you can leave a mark on the world that reflects your values and beliefs. You can also honor the memory of a loved one, or support a cause that they cared about. Donating to charity can help you create a meaningful and lasting impact that can benefit future generations.

How is your money used?

Over three-quarters of every 100 rupees donated to Hastinapura Yoga Foundation goes directly towards programs that help people access our Yoga program benefits. 80.4 rupees are invested to benefit through our programs and increase public awareness of Yoga, 7.2 rupees are spent raising the funds we need to deliver these programs, and 7.3 rupees are spent on making sure we have the talented people, infrastructure and systems in place to manage and deliver our programs and the remaining 5.1 rupees are invested in commercial activities. (e.g. our retail stores that sell personal care products)

Section 80G of the Income Tax Act, 1961

Donation to The Hastinapura Yoga Foundation qualify for tax deduction under Section 80 G (5) of the Income Tax Act of India, PAN AACTH8534L Unique Registration Number AACTH8534LF20231 Date of provisional approval 30-06-2023, which is existing and valid as on date of this receipt. Hence, upon realisation of the donation amount, this donation receipt qualifies to be considered as a Tax Exemption Certificate. It is important to note that this receipt is invalid in case of non-realisation of the donation amount or reversal of the realised amount for any reason.

What is the process for donating to our organization?

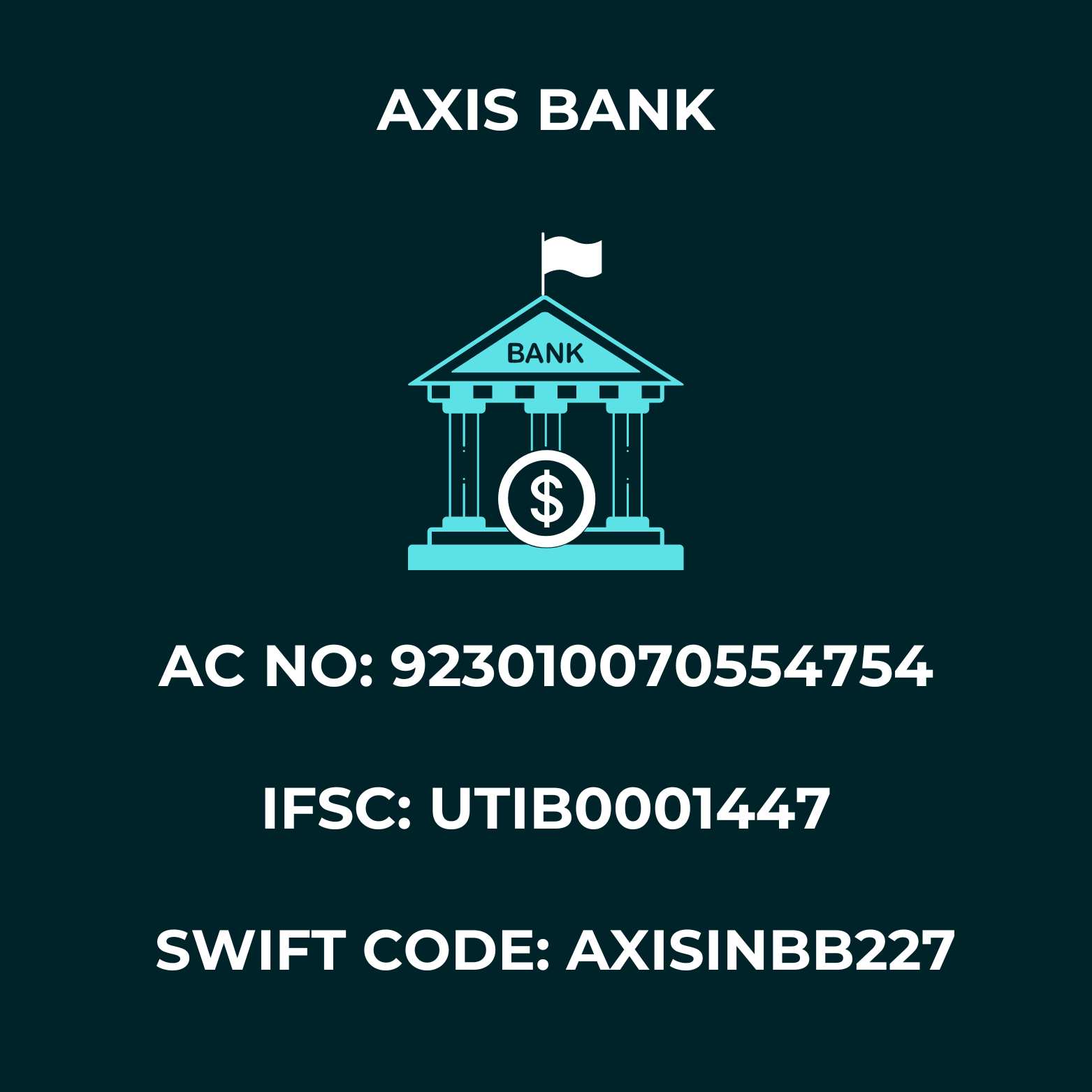

Bank Account

Giving Back to the Community

Donating to HYF is a way to give back to the community. By supporting their free yoga classes, you are helping individuals who may not have the means to pay for classes, but are still interested in improving their physical and mental well-being. This act of kindness can have a positive impact on the community, promoting a sense of unity and compassion.